Without a doubt, “deep tech” is one of the most discussed topics in technology. We constantly hear about how deep tech is having a significant impact on key economic sectors such as autonomous vehicles, robotics, smart homes and cities, medical devices, cleantech, fintech, and energy efficiency. Almost every aspect of modern society and the economy appears to be vulnerable to disruption.

But, before we go too far with deep tech, it is useful to define what the phrase actually means, as there is a lot of misunderstanding about its nature, where and how it can be applied, and the general scope and practicality of purportedly deep technologies with VCs and investors, as well as how powerful and expensive they are. The cost of research and development

Although it lacks a precise definition, “deep tech” is frequently used in articles about startups and innovation. The “tech” component is self-explanatory; it stands for technology. But there are many layers to “deep.” In order to denote a deeper understanding of a particular topic, we use it to mean the opposite of “superficial” and “peripheral.”

Prepare yourself for the next major wave of innovation, driven by cutting-edge deep-tech entrepreneurs and emerging technologies. Deep tech ventures aim to solve many of our most complex problems, so their economic, business, and social impact will be felt everywhere.

The great wave encompasses, among other cutting-edge technologies, quantum computing, nanotechnologies, synthetic biology, and artificial intelligence (AI). The convergence of technologies and methodologies, however, is even more significant as it will speed up and redefine innovation for years to come.

As long as the tech industry has existed, deep tech, a broad term for technologies not geared toward providing end-user services but also includes artificial intelligence, robotics, blockchain, advanced material science, photonics and electronics, biotech, and quantum computing, and has been a designated area for investment.

We observe a number of similarities in how and why technological advancements are being developed as they transition from the lab to the market and as businesses are established to pursue commercial applications. A potent ecosystem is also emerging to fuel their development.

When Moderna and the teams from BioNTech and Pfizer independently brought two COVID-19 vaccines from the genomic sequence to market in less than a year, we saw the strength of that deep tech ecosystem in action. Even though these businesses produced amazing results at previously unheard-of speeds, they benefited from the work of many other sectors, such as governments, academia, venture capital, and large corporations. These are all significant players in the upcoming wave.

Fasten your seatbelt for emerging technologies that will underpin their future.

Deep tech startups make up a tiny minority of new businesses, but their impact is enormous because they tackle big problems and produce both futuristic and usable work.

There are seven most promising fields of deep technology that are currently relevant. These are as follows:

1. Materials of the Future/Advanced Materials

These are new or improved versions of existing synthetic or biobased materials that perform better. Often, new materials are developed by combining two or more existing materials that differ significantly from one another but result in a material with its own characteristics (such as fiberglass), known as a composite material. Examples of such advanced materials include:

- Solar photovoltaic films

- Plastic that degrades naturally

Artificial Intelligence (AI)

AI is the simulation of human-like intelligence in machines that are programmed to think like humans and perform tasks that were previously only performed by humans. The introduction of voice assistants, medical imagery analysis, big data analytics, and other similar technologies shows that machines can be programmed to perform any task that a human can.

Biotechnology

Biotechnology is the process of creating valuable products by utilizing existing biological processes or developing new ones. Biotechnology is disrupting the current system through genetic manipulation of microorganisms for the production of antibiotics and vaccines, genetically modified seeds that are more resistant to climate change and pests, and so on.

Blockchain

Blockchain is a growing list of records called blocks that securely and transparently store a history of transactions. Users of the blockchain can view the history and add new blocks to the blockchain, but they cannot modify existing blocks.

It is, in fact, an open distributed ledger that can efficiently and permanently record transactions between two parties.

This advanced technology eliminates the need for intermediaries who serve as central, trusted authorities but are not transparent. Because the chain is transparent and cannot be altered, it initially disrupted the financial sector before moving on to disrupt other sectors such as healthcare, entertainment, and so on.

Drones and Robotics

Robotics is the intersection of science, engineering, and technology that results in the creation of machines called robots that perform tasks in an automated manner. Deep tech is typically used to develop robots to do work in industries where the working environment is dangerous or hazardous to humans.

The new technology incorporates human senses into robots to create more self-sufficient artificially intelligent robots that allow mobility and decision-making in an unstructured environment to assist humans in performing tasks more effectively.

Drones are a type of flying robot that is usually more mobile. These robots are frequently used to transport goods, map territory, or for surveillance, entertainment, and other purposes.

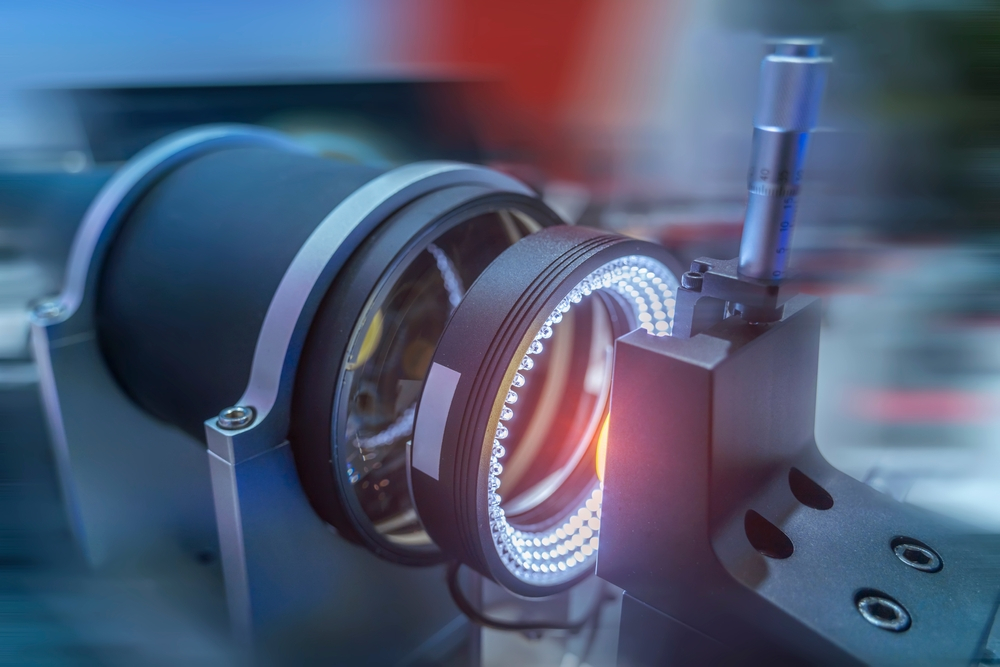

Electronics and photonics

Photonics is a branch of science concerned with the generation and utilization of photons (particles of light). It entails the use of lasers, optics, fiber optics, and electro-optical devices in a variety of technological fields such as alternative energy, manufacturing, telecommunications, security, and so on.

Electronics, on the other hand, make use of electrons’ power. Electrons are used to generate electricity, which is a form of energy.

Photons and electrons are frequently used in tandem to develop new deep technology.

Quantum computation

Quantum computing is the use of the unique properties of matter at the nanoscale to solve computational problems like integer factorization much faster than traditional computers.

There are several quantum computing models available today, such as –

Quantum Turing Machine, Adiabatic Quantum Computer, One-Way Quantum Computer, and Various Quantum Cellular Automata

The quantum circuit is the most widely used model among these. The quantum circuit, as opposed to classical computing, is built on qubits, which can be overlays of zeros and ones (part zero and part one at the same time). Furthermore, such qubits do not exist in isolation, but rather become entangled and function as a group. These two characteristics contribute to an exponentially higher information density than traditional computers.

Tens of thousands of startups are working on deep technology to bring in solutions that humans have only dreamed of. Deep Tech startups are full of innovation and a deeper understanding of how to use technology in a very effective and sustainable manner.

Why is deep technology so successful?

Deep tech has three key characteristics in the business context: potential for impact, a long time to reach market-ready maturity, and a significant capital requirement. Deep tech innovations are frequently radical, creating new markets or disrupting existing ones. based on tangible scientific discoveries or engineering breakthroughs.

They are attempting to resolve major issues that have a significant impact on the world around them. For example, a new cancer-fighting medical device or technique, data analytics to assist farmers in growing more food, or a clean energy solution attempting to reduce human impact on climate change. Continuing with the Uber example, deep-technology transportation companies would include autonomous vehicles, flying cars, and other similar transformative technologies.

Deep tech innovations are frequently radical, creating new markets or disrupting existing ones. Deep tech companies frequently address major societal and environmental issues that have the potential to impact everyday life. Silicon chips are an example of innovation that enabled previously unimaginable calculation speed and scale.

Deep tech startups require more time to transition from basic science to applicable technology than startups based on widely available technology (“shallow tech” such as mobile apps, websites, and e-commerce services[8][4]). For example, the technology underlying artificial intelligence took decades to develop, and now AI companies are rapidly expanding in a variety of fields.

The demand for large early-stage funding for R&D and prototype development, combined with deep tech startups’ lengthy life cycle, forces them to abandon the traditional funding progression from friends and family to angel and seed money, series A, and subsequent rounds leading to trade sale or IPO.

Business accelerators are also shifting their emphasis away from digital startups and toward deep tech ventures. Their primary risk is the technical risk, whereas market risk is frequently significantly lower due to the obvious societal value of the solution. [2] The underlying scientific or engineering problems that deep tech and hard tech companies solve generate a valuable intellectual property that is difficult to replicate.

Deep tech ventures that are successful typically have four complementary qualities:

They focus on solving issues

As is evident from the fact that 97 percent of deep tech ventures contribute to at least one of the UN’s sustainable development goals, they concentrate on solving significant and fundamental problems.

They operate at the convergence of technologies

At the nexus of technologies, they function. For instance, 66 percent of deep tech ventures use more than one advanced technology, and 96% use two or more. The majority of deep tech ventures—roughly 70%—have patents on their technologies.

They primarily create physical products rather than software

Indeed, 83 percent of deep tech ventures are working on a physical product. They are changing the innovation equation from bits to bits and atoms, bringing data and computation power to the physical world.

They are at the heart of a complex ecosystem.

The deep tech involves approximately 1,500 universities and research labs, and deep tech ventures received approximately 1,500 grants from governments in 2018.

Deep tech ventures, despite constituting a small minority of startups

Despite the inherent risks of failure, businesses and investors are becoming more interested in deep technology. According to our preliminary estimates, deep tech investment (including private investments, minority stakes, mergers and acquisitions, and IPOs) has more than quadrupled over the last five years, rising from $15 billion in 2016 to more than $60 billion in 2020. For startups and scale-ups, the average disclosed amount per private investment event increased from $13 million in 2016 to $44 million in 2020. While ICT and biopharma companies continue to make significant investments in deep tech, more traditional large enterprises are becoming more active due to the benefits.

Deep tech is becoming increasingly important to mainstream companies and institutions as a source of solutions to big problems and the future of innovation.

What kind of environment/ecosystem supports deep technology in India?

Deep technology is a type of organization, or more commonly, a start-up company, with the stated goal of providing technology solutions based on significant scientific or engineering issues. They create difficulties that necessitate extensive research and development as well as a significant capital investment before they can be commercialized successfully. They have been tasked with finding solutions to the world’s most difficult problems. DeepTech companies are those whose business models are based on high-tech innovation that takes advantage of current technological advances in a variety of fields.

DeepTech solutions are currently used by 19% of tech start-ups to establish product competencies in preparation for market expansion. Technical risk is the most significant risk in a deep tech or hard tech company, but the market risk is frequently significantly lower due to the potential societal value of the solution. Deep tech and hard tech firms solve fundamental scientific or engineering problems, resulting in valuable intellectual property that is difficult to replicate.

Without a doubt, India has undergone a digital transformation over the last decade. The ecosystem of technology start-ups has expanded rapidly. “Where does this leave Indian IT entrepreneurs, investors, and corporations?” asks the question. Due to the obvious ongoing technological revolution, deep technologies will be at the heart of the next wave of information disruption. It’s also the next big thing that businesses and venture capitalists are clamoring for. The question now is whether DeepTech firms are displacing commercial applications that were previously led by institutions, corporations, and the government.

Let’s take a closer look at it first.

Deep technology has the potential to create new markets as well as disrupt existing ones. Innovators and investors interested in the advancement of this technology frequently view the world through one of the following lenses:

Technology and science (such as quantum computing)

Industry (for example, advanced manufacturing or Industry 4.0) issues (such as skin cancer cure)

The enormous challenge (such as clean energy generation and climate change)

India’s digital transformation has accelerated in the last decade, particularly in the last two years. The technology startup ecosystem has seen significant growth as a result of technological adoption, but where does this leave Indian founders developing new technologies, investors, and corporations? Deep technologies, which will be at the center of the next wave of the information revolution, are the next big thing that both corporations and venture investors want after a decade of digital innovation. Is a new model for developing deep technologies emerging? Are deep tech startups taking over commercial applications that were previously led by institutions such as corporations and governments?

Driving innovation in 2021 has become more of a fragmented attempt, despite easier access to knowledge, skills, and information, as the Indian ecosystem sees the rise of powerful new platform technologies and falling barriers. This is the only reason why newer models are required.

India’s vantage points are unique, with a young population, increased connectivity, the emergence of corporate firms, and start-ups developing deep technological solutions. Deep technology is increasingly being used to boost growth in fields such as healthcare, education, industry and manufacturing, and others. India is quickly emerging as the next DeepTech hotspot.

This is especially true for early-stage enterprises when the majority of scientific risks have been mitigated and the initial product-market fit in developed economies has been achieved. Collaborations with businesses and accelerators can benefit early-stage entrepreneurs.

Investments in specialist funds and venture capital in R&D-intensive companies will help the Indian DeepTech ecosystem thrive and bring more sustainable solutions to the market. A new Indian DeepTech ecosystem is forming, with far-reaching implications for all stakeholders, particularly businesses, investors, and entrepreneurs. Investors are putting money into these companies. The reasoning is straightforward: early-stage companies in the field require more time and resources to bring their ideas to market, but more importantly, corporate and venture capital firms are warming up to making long-term, significant bets on new and emerging companies for the first time.

DeepTech solutions have the advantage of laying the groundwork for future businesses that emerging economies like India require. Institutional investors are well-positioned to lead the way in DeepTech, thereby increasing the amount of money available.

What distinguishes DeepTech?

It’s all a matter of science! Its origins can be traced back to research and development. (R&D). DeepTech reconstructs everything from the ground up after a scientific breakthrough or discovery. For DeepTech companies, product-market fit isn’t about A/B testing features and stages. It entails iteratively testing the technology and applying it to real-world scenarios. It also entails navigating the scientific domains and intellectual property that may be at the root of the shift. As a result, DeepTech has longer gestation periods. Depending on the idea, it could take months or decades for a technology to be ready for commercialization.

The allure of DeepTech businesses is well known among investors. In recent years, investment firms have been at the forefront of identifying and supporting start-ups focused on drones and robotics, Agritech, cybersecurity, and API-driven businesses.

DeepTech’s challenges stem from the complexities of the technology commercialization process, and they can be classified into three categories: a lengthy timeline, a lack of social and physical infrastructure, and a lack of finance. Successful cross-sectoral collaboration lowers barriers and expands opportunities. Corporations, DeepTech VC firms, academia, and the government are all collaborating on open innovation.

Dynamics of the Deep Tech Market

Key Drivers in the Deep Tech Market

Deep Tech companies are providing solutions to the energy power sector to upgrade current technology by utilizing cutting-edge technology to investigate hydropower generation and increase the efficiency of solar and wind energy.

Deep Tech is also used in the food and agriculture industries. It offers solutions that can prompt a shift away from traditional industrial farming practices and toward more sustainable methods of production. Various technologies, such as blockchain, big data, and biotechnology, are being used to improve interconnected farming systems with highly precise predictive capabilities, allowing farmers to harvest and grow their crops for maximum efficiency, yield, and resilience.

COVID-19’s Impact on the Deep Tech Market

During the pandemic, most businesses are implementing the work from the home module. To manage their profitability, businesses are reducing their investment in new technologies and services. Most small businesses closed their doors due to a lack of funds to stay in business.

Deep Tech demand is decreasing during the COVID-19 lockdown situation; however, it is expected to increase following the pandemic situation due to increased reliance on commercial sectors and services.

Deep Tech Market:

Deep Tech Market Research Scope, by Technologies

- Massive Data

- Machine Learning and Artificial Intelligence

- Robotic Language Processing

- Algorithms for vision and speech Quantum Computing Photonics and Electronics

The market for Deep Technology by Enterprise Size

- End-user Large Enterprises

- SMEs

Deep Tech Market

- IT & Telecommunications in the BFSI

- Automotive \ Healthcare \ Agriculture \ Others

Deep Tech Challenges

Despite its potential, the deep tech must overcome a number of obstacles before reaching its full potential. Four challenges stand out in particular, with implications not only for deep tech ventures but also for all ecosystem participants:

The requirement for reimagination

People aren’t always quick to recognize how science and technology can alter processes or solve problems. After electric engines replaced steam engines, it took businesses 20 years to rethink the factory floor.

Finding the right business framework can be difficult for deep tech ventures, which are frequently based on applying a technological breakthrough to solve a problem. Many people struggle to identify a compelling value proposition by reimagining value chains and business models.

The main challenge for large corporations looking to expand their innovation programs through deep tech is often imagining products and processes that come from a completely different source or process. Previously, 77 percent of industry-leading companies were still leading five years later, but in today’s more dynamic market, where continuous innovation and reinvention are critical to success, this figure has nearly halved to 44 percent.

Big companies may face the most difficult challenge of any participant in the deep tech ecosystem in this regard. Aside from understanding the applications and use cases of emerging technologies, large corporations must cultivate counterfactual as well as factual skills, cultivate playfulness, encourage cognitive diversity, and ensure that senior executives are regularly exposed to the unknown.

The requirement to push scientific boundaries

Although science has made enormous advances in many fields, researchers are still only scratching the surface of what is possible in many others. The complexity of nature, for example, is far from fully understood in biology. In chemistry, for example, the complexity of nanoparticles as multi-component 3D structures remains a significant design and engineering challenge.

Despite growing interest in soft robotics (the construction of robots from materials similar to those found in living organisms), researchers have produced few prototypes. The behavior of soft materials is difficult to understand, making it difficult to control and activate. Quantum computing has enormous potential, but it faces numerous technical challenges. Scientists have made significant advances in AI and machine learning, but many issues remain unresolved.

Governments, universities, and startups can all collaborate to push scientific boundaries and translate technical capabilities into business applications.

Difficulties in expanding

Deep tech firms create fundamental innovations that frequently result in new physical products, but they may lack relevant scale-up experience.

Scaling up a high-tech physical product—and the associated manufacturing process—can be difficult and expensive. In addition to establishing appropriate physical facilities, ventures must overcome engineering challenges while adhering to design-to-cost parameters. Corporations and governments can both help, with the former lending expertise in engineering and large-scale manufacturing and the latter serving as early test customers for the new product.

Difficulties obtaining funding

Although investment in deep technology has increased in recent years, the current investment model remains a barrier. Today’s widely followed venture capital model, in particular, is insufficient in scope and unevenly weighted toward specific technologies such as AI and ML and life sciences.

Making matters more difficult is the difficulty in deep tech of transitioning from the laboratory stage (which is typically grant or subsidy funded) to investment-based venture funding. Many private equity and venture capital funds are structurally restricted from investing in deep tech (due to lifetime, size, and incentive limits). Most cannot fully comprehend the risks associated with science and technology.

Furthermore, many venture capital funds have abandoned their original “venture” mindset in favor of following the lead of others or making safer bets on more-established and better-understood technologies.

For all of its devastation, the COVID-19 pandemic has also highlighted deep tech’s ability to solve a human problem of historic proportions—and to do so quickly, efficiently, and at a low cost. The coming great wave, in essence, brings a new approach to innovation by attempting to solve fundamental and complex problems.

Deep Tech Funding

It is not surprising that the Indian startup ecosystem has changed dramatically in recent years. With a new startup being formed every day, the country is currently at the forefront of innovation, fueled by emerging technologies and the development of deep tech solutions. This trend is accelerated by VCs and incubators assisting these startups in developing and scaling their product offerings and determining the best product-market fit. According to preliminary estimates from consulting firm BCG, investment in deep technology has more than quadrupled over a five-year period, from $15 billion in 2016 to more than $60 billion in 2020. Raising early-stage VC capital, on the other hand, has always been a difficult climb for deep tech startups. Long waiting periods and high capital requirements only complicate the process as investors try to come in later in the life cycle.

Deep tech ventures, due to their innovative nature, typically require significant upfront capital and time for R&D while also carrying a high risk of failure. The question is, first and foremost, how can startups and investors be more certain that they are on the right track to success.

The “four moments of truth” approach focuses on four critical questions that deep tech ventures must address concurrently at an early stage of their existence. The specific questions vary depending on the startup’s business case and operating industry, but they generally take the following form:

- What is the problem? Frame the paradigm. Could the truth be different?

- Forge the theory: Is it possible to create a solution? How can we make it happen?

- Take the first step: Can we construct the solution today?

- Change reality: What must occur in order for the solution to become the new normal?

Finding answers to all of these questions aids in the early identification of obstacles, or “frictions,” providing startups and capitalists with a better understanding of the risks to be faced in the next milestones. This framework can also be used to evaluate a startup’s performance at each milestone, guiding the business in the right direction.

Similarly, when asked what the criteria are for evaluating a deep tech venture, a deep-tech focus VC firm- shares that they place a high value on the problem being solved. “Does it require immediate attention? Is it true that we cannot live without oxygen? Is aspirin used to treat a painful problem that we must resolve? Finally, is it jewelry, which is nice to have but not necessary?”

Some key points that most deep tech startups can improve in their pitch decks

Concentrate on stating the problem. (For example, who the problem represents, how fundamental it is, and why it is critical that it be resolved)

This is especially important to remember if the founders’ team is all technical and academic, as they may focus too much on the beauty of the science and not enough on the “customers’ pain points.”

Define the competitive advantage.

It is undeniably difficult to build a good deep-tech startup, but in most cases, the problem that your startup is attempting to solve is also one that many others are attempting to solve. It would be advantageous for firms to correctly identify their competitive advantage, as well as how it can be built up over time/scaled-up process.

Creating a customer acquisition strategy

It often takes more than a great product to attract customers and generate economic profit. To persuade investors that their product will sell well, startups should have a collection of constructive feedback from end-buyers, a list of potential customers, and a plan for product distribution channels.

Finally, why is your solution important?

How will your technology make the world a better place?

- When will you reach the magical moment that will delight your customers?

- – How do you know your technology is important?

First and foremost, it is about creating a business that solves fundamental social problems and provides deep value by leveraging cutting-edge technology that traditional businesses are overlooking. The process entails bringing together Problem orientation, Design, Science, and Engineering to ensure the product’s innovative quality and technical and economic viability.

“The best technologies or the best problems to solve in the world have facets of oxygen, facets of aspirin, and facets of jewelry.” Deep tech startups can then combine presentation tactics in their pitch to better communicate their technological solutions and increase their chances of successfully raising funds.

Deep tech, also known as “frontier” and “hard tech,” refers to areas of robotics, life sciences, and space that rely heavily on advanced scientific knowledge and engineering. According to industry insiders, a slew of issues such as COVID, climate change, and increased global competition have elevated the space in the eyes of many investors.

A big shift

Since deep tech spans so many different—and large—sectors, it can be difficult to pin down a single set of venture dollars to demonstrate trends in the field. However, quantum computing, which has long been associated with hard-tech investing, could be a good indicator.

Investment in quantum computing—a level of computing much faster and superior to classical computers that examine quantum states to perform computation—has already reached record levels this year, with venture funding expected to exceed $1 billion. More than $728 million has been invested in the sector so far this calendar year, surpassing the $515 million seen last year.

Investors appear to be optimistic about what quantum could mean in areas such as finance, security, and life sciences. While quantum computing investment may demonstrate how deep-tech investing is intensifying, other sectors associated with hard tech have seen significant investor interest as private markets remain flooded with cash and everyone is looking for new—and sometimes overlooked—opportunities. Dollars continue to flow into these sectors, from the burgeoning space technology industry to therapeutics.

Why should you invest now?

While it is easy to say that these various hard-tech sectors are at all-time highs due to the massive increase in venture funding across the board, those who have been investing in the space for years say recent events have drawn more attention to the area.

Unsurprisingly, the COVID pandemic is one of those watershed moments.

“COVID has had an interesting effect on what people want to invest in and do with their lives in general.”The pandemic has heightened investor interest in life science and pharmaceutical companies. Others in deep technology have noticed an increase in interest in life sciences. People were interested in this area prior to COVID because it was interesting.

“Over the last two years, people have seen the need for hard automation through robotics” as a result of workforce disruption.

Other areas, such as climate technology, have been popular for more than a decade, but the deep-tech strategies surrounding it have shifted and drawn new attention. While electric vehicles were popular a few years ago, those in deep tech—as well as many other industries—are now looking to other decarbonization technologies as the next frontier.

Investors’ risk tolerance levels and competitive advantages differ, so investors must understand how to minimize risks while maximizing competitive advantages by selecting the right deep tech domains.

The majority of startups we see on a daily basis fall into two categories: Deep Tech (tech-driven companies) and Business Model (operation-driven).

For business model companies, investing in them is simply a bet on the team — the company’s success will heavily depend on the team’s operation, marketing, and management experience; if they are more established, operational numbers will mostly guide the investment decision.

Furthermore, there is always a strong trade-off between return and risk for business model companies. At the very early stages of a startup, the potential return and risk are extremely high. As the startup grows, each new user becomes part of the company’s assets, which can be sold even if the company fails.

Having said that, the outcome of investing in these types of companies is unlikely to be binary — 0 or 1, and the risk is thus managed in some way. As a result, as the startup matures, people can fairly easily price the risk, and the potential return (as measured by the number of acquired users, CAC, and LTV) can also be fairly accurately measured and priced.

For Deep Tech Companies

The evaluation process becomes complicated for deep tech companies, and determining the return-risk trade-off is difficult. Deep technologies will differ in terms of “enabling power,” total addressable market (TAM), and risk (technology-readiness-wise and competition-wise). We will face more variables as investors. How can we decide what is more important? Which types of deep technology are more appealing to investors?

Deep technologies differ from one another.

Deep technologies are classified into three layers based on the effects they have:

Level 1: Technologies that have the potential to fundamentally alter how the world works (for example, new materials, AI/ML, blockchain, and so on).

Level 2 technologies build on Level 1 technologies to create new platforms or infrastructure for industries (e.g. cloud computing, edge computing, computer vision, AI tools, etc.).

Level 3 technologies are those that are built on top of either Level 1 or Level 2 technologies and are tailored to specific industries in order to improve industry performance (e.g. AI for finance, computer vision for security, computer vision for manufacturing, etc.).

When evaluating investment opportunities for different levels of deep technologies, we really care about different things.

We don’t need to be concerned about the potential market size of Level 1 technologies because they will completely change the world. However, the real dangers here are as follows:

- The technology is still a long way from commercialization.

- The problem has not been completely solved by technology, which is rapidly evolving.

- The CTO/tech team is untrustworthy.

- Potential customers may not see much benefit from the technology.

- There is no IP address.

- Technology will quickly become a commodity.

- The company has not secured sufficient funding to complete development.

What we want to look at when evaluating an investment in this domain based on these risks is:

- How far is the technology from being commercialized?

- How quickly is technology evolving?

- Does the CTO/tech team have a strong technical background and a large number of patents?

- Has the technology been validated by any pilot customers?

- How secure is the technology?

- How likely is it that it will become a commodity?

- Existing investors with large sums of money?

- What are the technology’s applications?

The market size for Level 2 technologies is still unlikely to be an issue. However, we might wonder whether a cross-industry “platform” is appropriate for this technology. It makes sense for cloud computing because industry customization is not required, and a scale of a business can offer cost advantages. It may not make sense for AI tools because different industries will require different AI tools.

As a result, the risks for Level 2 technologies will be as follows:

- Customized solutions cannot compete with the product.

- The company is addressing an overly broad market.

- The problem has not been completely solved by technology, which is rapidly evolving.

- The technology has yet to be validated. The size of the business does not benefit the company.

- The technology/product is commodified.

- Chinese firms may pose a threat to the company.

- Regardless of the high ARR, the company may have a very low margin.

- The company may not have enough funding to expand.

As a result, the following questions must be addressed during due diligence:

- How secure is the technology?

- Has the industry-validated the technology?

- How quickly is technology evolving?

- Does the size of a company matter? Is personalization important?

- How does the company set itself apart?

- How do you compete with similar Chinese firms that may have lower costs?

- How profitable will the business be?

- Is there an existing investor with large funds?

The market size may become an issue for Level 3 technologies as companies tailor solutions for small/niche use cases. While technology may not be a major issue in this case. For example, when evaluating an in-car environment monitoring company, we are concerned about the potential market size and exit opportunities for investors rather than the computer vision technology.

Risks associated with these technologies/companies include:

- The market is far too small.

- The team is lacking in marketing, operations, and sales experience.

- The team lacks sufficient BD talent (pipeline & execution).

- Due to a lack of industry knowledge, the team does not provide the best “product.”

- The product is not sufficiently differentiated.

- The market is already oversaturated.

- If the market size/business is small, exit opportunities are limited.

As a result, our investigation will center on:

- What is the market size like?

- Is the CEO/founding team well-versed in marketing, operations, and sales?

- Is the CEO/founding team well-connected in the industry?

- How does the company set itself apart? What is the target market’s level of competition?

- Will there be any potentially appealing exit options?

- What are the comparable previous deals like?

Based on their preferences and competitive advantages, investors should select the most advantageous domains.

We further categorize technologies beyond the three levels of deep technologies based on their impact level and the space in which they are impacting (physical or digital).

Category A: Level 1 technologies impacting the physical space

Category B: Level 1 technologies impacting the digital space

Category C: Level 2 technologies impacting the physical space

Category D: Level 2 technologies impacting the digital space

Category E: Level 3 technologies impacting the physical space

Category F: Level 3 technologies impacting the digital space

The risks differ for these groups. Only God knows the answers to some of the risks. We can conduct research and reduce some of the risks. We will eventually want to make the fewest “bets” and earn the highest return based on what we can do — our competitive advantages as investors.

Different investors will have different capabilities and competitive advantages in general. Some may have extensive knowledge of material science, while others may have a strong network in specific industries or deep pockets to participate in long-term “battles.” Investors may need to choose domains with fewer God-knows and a better fit with their competitive advantages to succeed.

There are many unknowns in Category A/B technologies that few people in the world can predict. These unforeseen issues include:

- The technology can be quickly commercialized.

- The technology will not be quickly replaced.

- The CTO/tech team is capable.

- IP can be completely safeguarded.

- We can invest more in this technology than Google.

Meanwhile, we can research to mitigate the following risks:

The technology’s worth/applications

If we want to succeed in this domain, investors must have the following competitive advantages:

- Deep expertise in a specific field.

- Strong understanding of technological evolution.

- Strong academic and industry networks to help validate the value of technology.

- Deep pockets are required to compete with behemoths.

The risks for Category C technologies revolve primarily around intellectual property protection, as it is not difficult for Chinese manufacturers to examine and copy a hardware design, resulting in cost savings.

- The technology will not be quickly replaced.

- The CTO/tech team is capable.

- Chinese firms will not have a cost advantage.

- IP can be completely safeguarded.

The risks that we can investigate are also limited:

The technology’s worth/applications

Successful investors in this category will require the following:

- Deep expertise in a specific field.

- Strong understanding of technological evolution.

- Strong academic and industry networks to help validate the value of technology.

The main unknowns for Category D technologies are:

Commoditization will proceed at a reasonable pace.

The margin will not be too thin.

To reduce risks, we can investigate the following:

- The advantage of the business scale.

- The advantage of customized solutions.

- Competitive advantage and differentiation strategy

Investors should have the following skills to make successful investments in this category:

- A thorough understanding of potential customers.

- Competent analytics abilities.

- Strong industry network to validate the technology’s value.

The most uncertain aspects of Category E technologies are:

- The team can lead the company to victory in competitions.

- Chinese firms will not have a cost advantage.

- IP can be completely safeguarded.

- The underlying technology will not be quickly replaced.

While we can still research to confirm:

- The size of the market.

- The technology’s worth and applications.

- The level of competition.

Successful investors will have the following characteristics:

- Strong industry network to aid in business expansion.

- Competent analytics abilities.

Finally, the true uncertainties in Category F technologies revolve primarily around the team:

- The team has the ability to lead the company to victory in competitions.

- The underlying technology will not be quickly replaced.

We can look into the following to reduce risks:

- The size of the market.

- The technology’s worth and applications.

- The level of competition.

To succeed in this domain, investors must have the following competitive advantages:

- Strong industry network to aid in business expansion.

- Competent analytics abilities.

Why investing in Deep tech yields a higher ROI

While the deep technology, or deep tech, industry is growing rapidly, the definition of deep tech is still not widely accepted. The term “deep tech” is somewhat ambiguous, referring to a group of start-up businesses whose goals are to address large problems or engineering/scientific setbacks. Because of this broad definition, deep tech firms use everything from artificial intelligence to blockchain to robotics. These companies’ wide range of offerings allows for profitable investments and free-flowing capital markets.

1. Deep Tech has a lot of potentials, according to the numbers

Deep tech capital markets have expanded significantly in recent years. According to their research, “dry powder” investments (investment capital seeking high returns) are at record levels. These early investments have already produced incredible results for the industry, which was valued at $18 billion in 2018. The synthetic biology subindustry alone is expected to grow to $23 billion by 2023. Those figures are enticing to any potential investor because they promise consistent growth and high margins.

2. Deep Tech Firms Use Cool Technology to Solve Big Problems

Deep tech start-ups are working to solve some of the world’s most pressing problems, such as food shortages, medical issues, and even climate change. According to research, deep tech companies were active in the health care market, developing products such as AI diagnostics and wearable health trackers. Other startups are using artificial intelligence to assist farmers with crop predictions and yields, thereby reducing food shortages. Some of these businesses are using blockchain to connect farming systems for increased efficiency. Deep tech startups are known for solving problems with emerging technologies or by developing their own. Over 83 percent of deep tech ventures were designing or building physical products that could be patented and sold for a profit.

3. Deep Tech Companies are Frequently Overlooked in the Capital Markets

Deep tech firms are frequently overlooked for investment due to a greater need for capital markets and a longer time to market readiness. Many deep tech companies spend months or years developing working prototypes or technology. While this may appear discouraging to an investor, it can be advantageous.

The low valuations of deep tech companies provide significant returns later, according to a company that funds many deep tech startups. Furthermore, because the majority of the capital required is front-loaded, the investment can be much more cost-effective once the startup is market-ready and profitable. Early investments in deep tech startups have already yielded amazing results for society and the economy, resulting in the rising number of unicorns. A unicorn is a classification for a startup company valued at over $1 billion. For deep tech startups, the goal is to become a unicorn.

Deep tech startups offer significant returns to investors as well as opportunities to have a significant positive impact on society. Deep tech companies hold themselves to a higher standard because they rely on their technology to make a profit. Many more companies are emerging from the shadows as the deep tech industry expands. We discovered that approximately 1,500 of the deep tech companies surveyed were involved in universities and research labs. These startups come from all over the world, opening up new untapped capital markets for any investor.

A deep-tech investor will frequently notice that deep tech startups have a different evolution cycle than a typical B2B or B2C company. As a result, the challenges they face along the way differ — commercialization is more complex, and founders are frequently required to approach it differently.

Deep tech companies are typically built around a novel technology that offers significant improvements over existing market solutions; they frequently create new markets that do not yet exist. Bringing these technologies from “lab to market” necessitates significant capital and a much higher level of risk than a typical venture investment.

The majority of venture capitalists are frequently surprised by the amount of complexity involved in launching a successful deep tech company.

High reward, high risk

Since most deep tech companies are based on fundamentally new and unproven technology, they are riskier. Typically, the technology has been tested in a lab or research facility, and the early results are often obtained in a controlled environment. As a result, founders are likely to face technical challenges while developing a product and will not be able to eliminate the technology risk until later in the process. However, if successful, they have the potential to outperform the average venture investment.

Putting technology first

The technology-first approach of deep tech companies is an obvious but fundamental difference. Typically, the founder has created a novel technology or intellectual property (IP) as part of their Ph.D. thesis or postdoc work and is looking for a real-world problem that it can solve. Most startups, in general, choose an existing problem in a market they are familiar with and create a product that solves that problem, and they have a clear understanding of the problem they need to solve.

Deep tech entrepreneurs, on the other hand, take the opposite approach, and as a result, they frequently suffer from SISP (a solution in search of a problem), as Y Combinator refers to it. Founders must be aware of this and be willing to pivot and repivot as a result of market and customer feedback.

Deep tech is statistically speaking the future. Its wings are spreading faster than a forest fire. Deep technology now has a significant impact on almost every important sector of the economy, including the automotive industry, robotics, smart homes, smart cities, healthcare, fintech, agrotech, edtech, and energy efficiency.

Almost every aspect of modern society appears to be ripe for disruption by deep tech.

I’m excited to see what the future holds – it appears to be becoming increasingly artificially intelligent.